Representatives from CACI, which specialises in understanding consumers and their locations, outlined how data analysis and demographics can inform childcare strategy and support providers to expand.

Large nursery groups like Busy Bees, Monkey Puzzle and N Family Club already use this form of intelligent data-gathering to pinpoint areas where there is demand for childcare.

Arabella Dalloz, senior consultant at CACI said that the main focus in the childcare industry is to support client’s acquisition strategy and help them to understand the consumers that they deliver services to.

She said, ‘There has been a lot of change in the past 12 months and for us it’s about where is there the greatest demand for childcare; how consumers are changing; understanding migration; if customers are moving potentially earlier than they might have done previously as a result of the new changes to our lifestyles; and planning for the future for operators that we work for with the easing of restrictions and investment going forward.’

Looking at the latest data on how the pandemic has impacted on household’s spending habits and lifestyles, Paul Langston, associate partner at CACI, said that 74 percent of those surveyed said that their finances are better or unchanged since the start of the pandemic.

He hinted, ‘There could well be a spending boost which could lead to a childcare boom.’

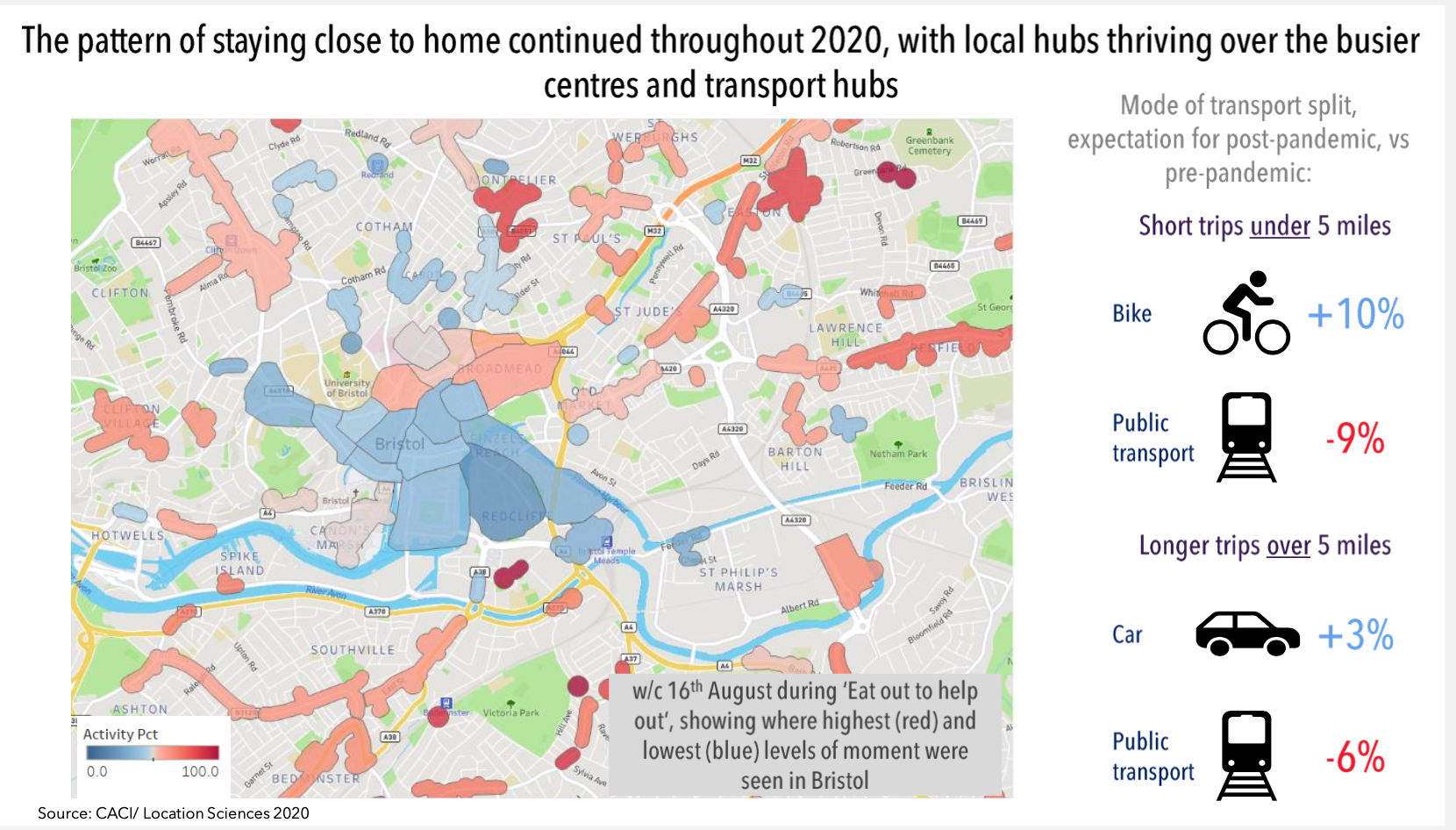

Changes to use of public transport

'The rise in localism is here to stay and could change the geography of childcare' - CACI

When it comes to how people’s transport preferences are going to change after the pandemic, he said, ‘What we are seeing loud and clear is that consumers are very nervous about using public transport and plan to reduce their movements going forward.

‘This could potentially have knock-on effects. If you have sites near the stations, you will you be paying a lot of money for those premium sites and you could you see some risk there. People might be thinking about using bikes more, so should you think about putting some bike facilities in for people when they drop off and pick up their children?’

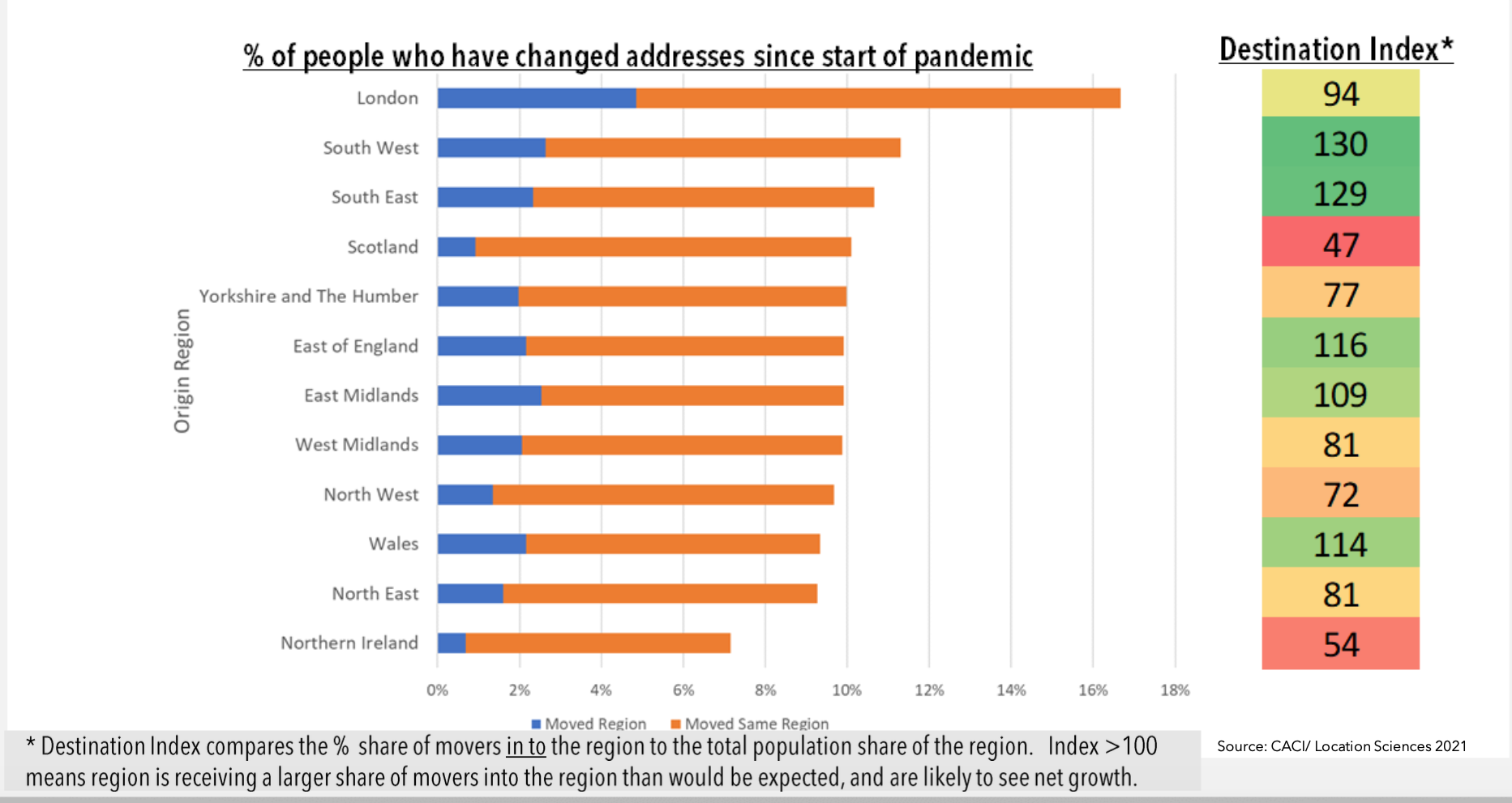

Also, there have been anecdotal stories of mass migration out of London. But the data shows that 17 percent of Londoners tracked at the start of the pandemic now live in a different neighbourhood in the capital to where they were at the start of the pandemic.

New opportunities in the South?

Londoners are the most likely to move house or region, but it is not an exodus. The other southern regions have gained the most movers

Source: CACI

Mr Langston said, ‘This is 6 percentage points above the average to the UK and gives some evidence to the anecdotal evidence but it is not a mass exodus. But many of these may be people moving back to family in the short term or to larger spaces outside of the capital.

‘London has seen the greatest overall drop in population. And there is evidence that more people have moved to the South West and South East. We don’t know whether that will continue but it could be an opportunity for growth in these areas.’

FREE DATA OFFER FOR NURSERY WORLD READERS

CACI is now partnering with Nursery World to offer all providers the chance to access the current year of demographic data of one of their existing nurseries, for free during the month of March.

This will enable providers to quickly learn about their target consumers and the catchment nursery sites within their area.

Sophie Hailey, Monkey Puzzle’s franchising and property acquisitions associate, said, ‘Before we engaged with CACI, when we were looking at a new site, the only demographic research we would do was competitor analysis. We would type the site postcode into the Ofsted website and look at comparable sites in a five-mile radius. We would mystery shop them to find out about what they offered, the fees and waiting lists, to help us establish a suitable proposition and pricing for our potential new nursery.’

But with the catchment and demographic analysis, Ms Hailey can now see where there could be more potential and help her franchisees make the most of it. She can create reports about customers in the local area for franchisees, to help them target leaflet drops, supermarket advertising and digital promotion.

She added, ‘The site reports we generate [through CACI] help us to narrow down potential sites quickly – we look at a number of factors about the catchment that tell us whether it’s worth investigating a proposed site further. We can see how close it is to existing sites, so we can avoid cannibalisation, as well as how strong the customer demand might be in the local community and workforce.’

- If you have missed any of the Business Summit sessions, which took place on 4 and 5 March 2021, recordings, including handouts, are available after the event for a limited time. Registration includes access to the recordings on-demand, which you can view in your own time for up to three months after the live event.

- Find out more here