Childcare is now seen as equally essential to the functioning of a community as energy, according to a leading property expert, fuelling an ‘unprecedented’ boom in investment from across the globe.

Courteney Donaldson said the increase in the number of parents in work over the past 20 years, the Government’s ‘commitment’ in the form of 30 hours, and the weak pound, had signalled that childcare is a sound bet.

The Christie & Co’s childcare managing director told Nursery World, ‘The word we are hearing a lot of is “infrastructure”. Nurseries are increasingly seen as essential to community infrastructure. It’s because of that conception that overseas investors want to invest in childcare – when historically they might have invested in oil, gas and telecoms.’

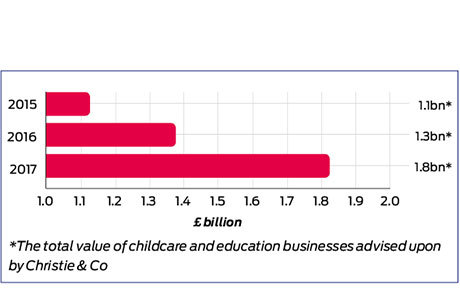

Between 2016 and 2017, deal volume – the number of nurseries bought and sold – increased by 20 per cent. In 2015-16 it was 12 per cent.

She added, ‘The strength of the market has been unprecedented. Demand continues to exceed supply.’ This was also reflected in the average price for an early years setting, which rose by nearly 9 per cent last year.

Speaking about the launch of the Christie & Co Business Outlook report last month, she said the value of childcare and education businesses that Christie’s has advised upon rose from £1.1bn in 2015 to nearly £2bn in 2017.

Ms Donaldson: 'The strength of the childcare market is unprecedented'

One year after the first major foreign investment in the UK childcare market for two decades – Magic Nurseries’ sale to French multinational Les Petits Chaperons Rouges – the Christie’s report talks of a market that is ‘going global’.

‘In 2015, we started to see steady interest around education and social care,’ said Ms Donaldson. ‘Several times a week investors phone us and say they are researching the market. They are pretty unlikely to buy just one nursery; they need an existing management team.

‘Markets are all driven by confidence. As more transactions have been completed, other investors look at them and they see confidence.’

She said she receives calls from investors from all over the world, including Canada, the USA, Iceland, UAE, Qatar, Malaysia and Singapore, the Philippines, China and Australia. ‘I get calls from countries I’ve never heard of,’ she added. To date, she has not had interest from South America or Russia.

Ms Donaldson said investors included:

- Private investors (e.g. high-net-worth individuals) with £0.5m to £2m who want to invest in a UK nursery. In one case, an individual had education investments in other countries and wanted to add a UK nursery operator to his portfolio.

- Investors with funds up to £1bn looking for early years groups worldwide.

- Trade investors – small to large overseas nursery groups.

- Education groups that have a K12 offering (UK Reception age to Year 12), but don’t yet have an early years division, wanting to buy small groups of nurseries to add to their schools business.

- Investors from unrelated sectors – e.g. telecoms or ecommerce.

CHINA

The UK’s expertise in childcare is now a major export, with China the most significant international market. This is reflected by the Department for International Trade’s recent mission, which took 14 representatives of UK nurseries and training providers to China last September in a bid to promote British early years expertise and the EYFS there.

British businesses that have opened Chinese settings to date include British Early Education (with a 300-place international nursery in Yixing), nursery group Happy Tree – which has three settings in London and opened a new childcare facility in Shenzhen – and Busy Bees, whose first setting in Harbin has eight ‘classrooms’ on a 3,087 square metre site.

Ms Donaldson said the growing interest in China was fuelled by the revocation of the ‘one child’ policy, which led to a year-on-year increase in births of 1.3 million to nearly 18 million births in 2016.

Aspirational parents were increasingly interested in high-quality bilingual early years education, she said, while formal early years education, which ‘has traditionally been a very small sector’, is now entering a period of ‘significant growth’. However, ‘the operational experience, knowledge and expertise is lacking – that is why there has been such a focus on the EYFS’.

Ms Donaldson predicts the trend will continue and British early years expertise could be exported further afield in Asia.

PERIOD OF UK CONSOLIDATION

Back in the UK, the market is consolidating, though not solely due to interest from abroad. Unprecedented increases in costs (the introduction of the National Living Wage in 2016, increases in business rates and pensions costs) and 30 hours strains are taking their toll.

The sector is highly fragmented, where 80 per cent of private day nurseries are owned by individual operators. The 30 hours is driving an increase in closures, principally ‘small-capacity nurseries in less affluent areas’, though property expert Courteney Donaldson thinks the reasons for closure are a ‘culmination of all these factors’ rather than just strains imposed by the 30 hours. Conversely, there has been an increase in ‘new-build, future-proofed, bespoke building settings that want to give parents “more”’.

Ms Donaldson predicts that in five years, we could see:

- a far wider number of regional groups with 50-150 nurseries

- more nursery groups partnered with overseas early years education groups

- investors from other countries that are owners or majority shareholders of UK groups

- an increase in socially responsible models of childcare.

The current picture is ‘not just about investment to generate financial return’, she added. The profile and success of the London Early Years Foundation, which operates as a social enterprise and targets disadvantaged families, and Childbase, which has pioneered an employee-ownership model, are making waves. ‘This has generated interest from UK operators who are looking to switch models. Some owners have no intention of selling and want to create a legacy for their staff,’ she said.