DOWNLOAD THIS ARTICLE AS A PDF

- More than one in ten practitioners live in poverty, with a household income of £17,000 or less (average UK household income is £29,400)

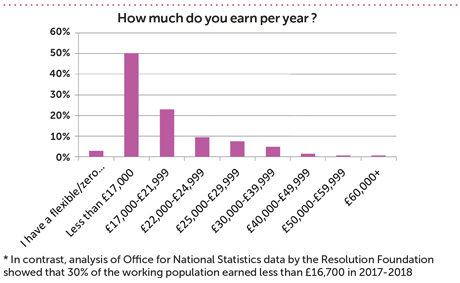

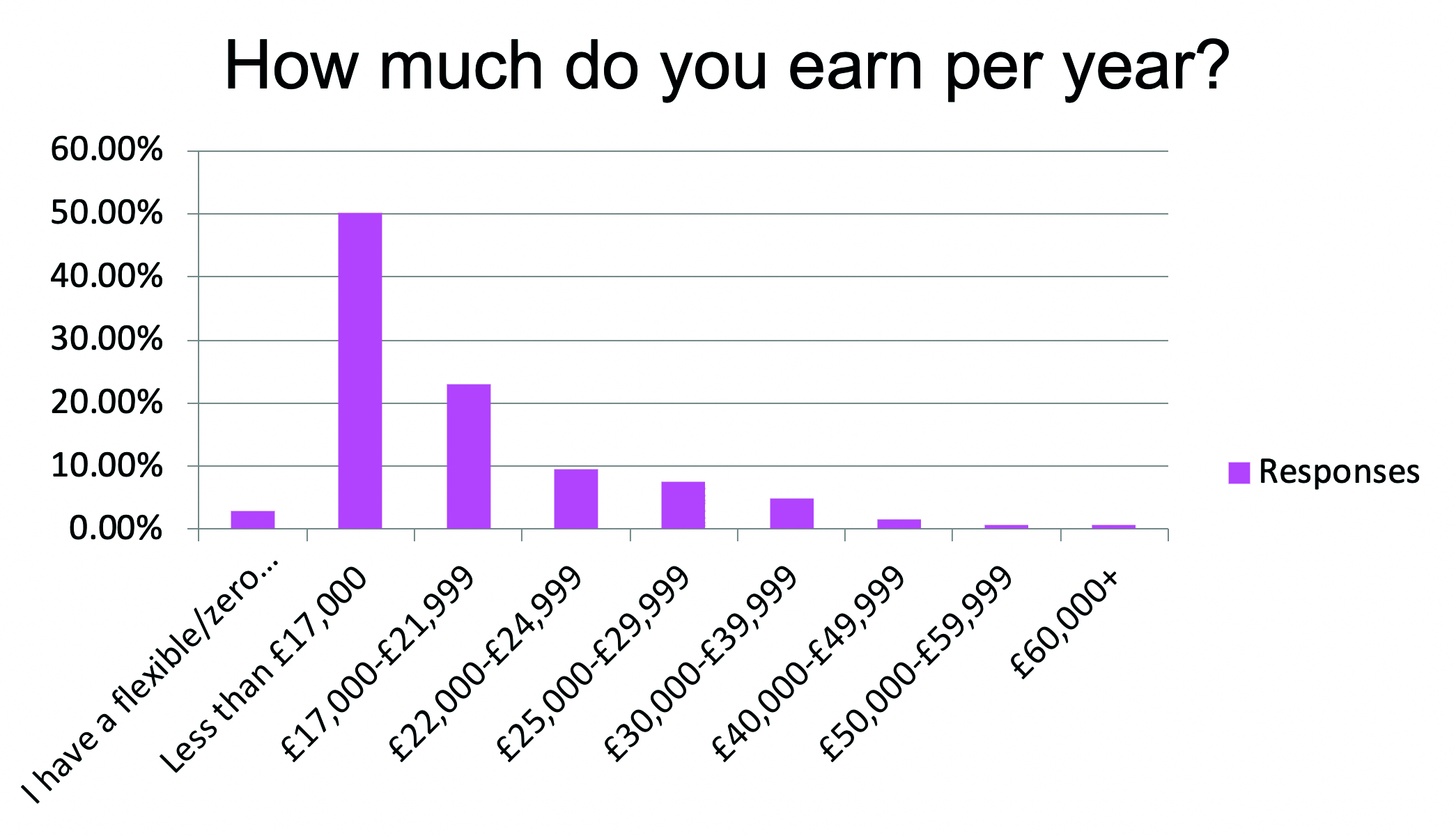

- Half earn less than £17k

- A third spend more than 30 per cent of income on housing costs – for single people with children this is 53 per cent

- Nearly one in five have £100 or less left to spend per month in their household once bills are paid – a third for single people with children

- Nearly a third of respondents with children can’t afford to go away for a week once a year

Half of all childcare workers earn poverty wages, with significant numbers struggling to keep up with housing costs, save money or provide for their children, according to findings from Nursery World.

A survey looking into the financial situation of the childcare workforce found that 50 per cent of respondents earn less than £17,000 per year. And while some rely on a partner’s earnings, more than one in ten (14 per cent) have no extra cash coming in – leaving them officially in poverty.

Relative poverty is defined as being on income which is less than 60 per cent of the UK average – which is £17,640 a year.

Having a degree is no guarantee against poverty pay either, our survey found, as 10 per cent of staff with degrees were in poverty.

Laura Gardiner, Research Director at the Resolution Foundation, said, ‘Childcare workers have been first-hand witnesses to the problem of working families in poverty, but these figures show they are disproportionately likely to have experienced in-work poverty too.’

Our survey, which attracted 1,029 responses, revealed the extent to which educating young children is becoming a ‘luxury profession’ because wages do not sustain a decent standard of living. One respondent said, ‘I am now lucky enough to have a partner with an income level which means I can afford to work in childcare.’

Neil Leitch of the Early Years Alliance said, ‘The survey highlights that working in the early years sector seems to be a luxury afforded to professionals who live with a partner or who live at home with parents. Even then, cohabiting does not necessarily mean childcare workers escape poverty. This is appalling.’

HOUSING

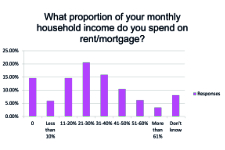

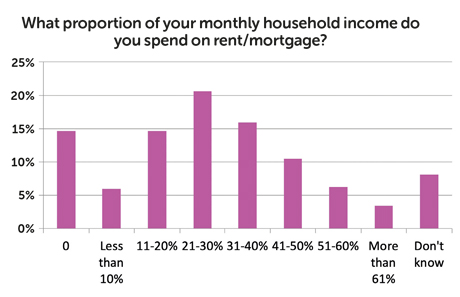

Because wages are so low, housing costs take up a disproportionate proportion of income. We found that one in five spend more than 40 per cent of their income on housing costs, while one in ten spend over half of their income on mortgage or rent. In comparison, the average proportion of annual earnings spent on housing costs is 29 per cent, according to the ONS and Halifax.

Once the monthly bills are paid there is less than £200 left for 37 per cent of people we surveyed (around half of whom had less than £100). This is much lower than typical household income estimates would indicate. The average UK household had £2,450 per month post-tax (before bills) last year, according to the ONS. Even with housing costs of 40 per cent that still leaves £1,420 left to pay remaining bills.

CHILDREN

Shockingly, some said looking after other people’s children does not pay enough to have children of their own. One respondent said ‘I have had to think when I can afford to have children - I do not know if I can afford to.’ Another said they were only having one child (see box p.8). However this was rare, and over three-quarters (76 per cent) of respondents had children. Of these, 15 per cent were single.

Strikingly, 80 per cent of childcare workers with children in our survey did not use formal – i.e. paid-for – childcare. While this may be because the children are too old to need it, the majority of those who do use it used paid-for hours (57 per cent). Free entitlements were used instead or in addition by 43 per cent (respondents could tick multiple options), including 5 per cent on the funded two-year-old entitlement.

Of those using paid-for hours, 30 per cent bought more than 20 hours, indicating the funded entitlements are not enough for many parents.

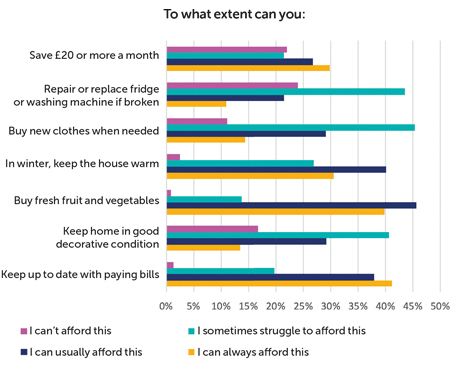

Unable to afford the basics

We found 33 respondents had used a food bank in the past year (4 per cent) - 8 per cent for those who were single and had children. We also looked at material deprivation, asking questions which are aligned with what the Government thinks is below an acceptable standard of living. We found:

- 12 per cent of respondents said they can’t or sometimes struggle to afford to buy their child a warm winter coat

- 21 per cent said they can’t or sometimes struggle to keep up to date with bills

- 29 per cent of respondents with children can’t afford to go on a family holiday once per year, and 33 per cent say they sometimes struggle to afford this

- 39 per cent say they can’t or sometimes struggle to send a child on school trips

- 43 per cent can’t or sometimes struggle to save £20 per month

- 68 per cent of respondents said they can’t or sometimes struggle to replace a washing machine if broken.

Mr Leitch said, ‘It is absolutely shocking that early years professionals who responded to the survey have been driven to using food banks, or struggle to buy a warm winter coat for their child. How can practitioners focus properly on their job if they are worried about putting food on the table when they get home?

‘The fact that so many are in severe financial hardship is a direct consequence of the £662 million funding gap in the early years. Childcare professionals deserve better than this.’

QUALIFICATION LEVEL

We already know that pay for Level 3 qualified staff in childcare is closer to that of cleaners than equivalent jobs in other sectors, and that managers are paid £7 less per hour than other professional jobs such as teachers (Ceeda’s About Early Yearssurvey, 2018).

We also know that people with a degree cannot always expect a pay rise – but may often get more responsibility – once they have completed their training. According to research from Voice and PACEY, only 37 per cent of those with Early Years Teacher Status had improved pay as a result. This is compared with 66 per cent of those with QTS who said their income improved as a result of their qualification.

So what does our survey tell us about the difference a higher qualification makes to lifestyles? We looked at the data for Level 3 versus degree-qualified staff and found:

- While 81 per cent of Level 3 practitioners earn £21,999 or less, degree-level practitioners are close behind, with 63 per cent on this salary level.

- What does this mean for household incomes?

- 1. While 14 per cent of Level 3s have ‘poverty’ income of less than £17,000, this was the case for 10 per cent of degree-level staff.

- 2. While 45 per cent of degree-level practitioners had a household income of £40-60k, just 23 per cent of Level 3s did; 43 per cent of Level 3s have a household income of £29,999 or less.

- 3. Looking at income left after bills are paid, 17 per cent of Level 3 and 15 per cent of degree-level practitioners had just £100 left per month.

- Degree-level staff are more likely to say they can save £20 per month, but there is not much in it: 23 per cent versus 19 per cent of Level 3s.

‘I can’t afford to go on holiday for one week per year’ was picked by 30 per cent of Level 3s and 23 per cent of those with a degree. One graduate-level respondent said, ‘I rely on my savings from money left to me by my parent in order to pay for luxuries such as holidays – for the hours I do the job is not well paid at all and I have considered leaving as less skilled jobs are paid more.’

And qualification level doesn’t make that much difference to stress levels – 63 per cent of Level 3s versus 56 per cent with degrees are stressed about finances very or fairly often.

Parents have reacted with horror to our findings. Sophie Gardner, who has a six- and a three-year-old, said, ‘Wow, this is disgusting. You wouldn’t want someone there who was only in the job for money, but this is ridiculous. Having a degree makes these people better practitioners, so why is this not reflected in their pay?’

The Government says it is investing ‘more into childcare than ever’ with £3.5 billion this year spent on free education entitlements plus £20 million on improving training, and an additional £66 million announced in the spending review. But the sector says this is not enough and that low pay is a direct consequence of underfunding.

Purnima Tanuku, chief executive of NDNA, said: ‘It’s time the Government stopped taking advantage of practitioners’ passion and properly invest in our children’s early education. It’s shocking that half of Level 3 qualified practitioners who have studied over an 18-month period are classed as being in work poverty, and those that studied to degree level have little to no benefit in their take-home pay. Where is the motivation to study and progress?’

Liz Bayram, chief executive of PACEY, added, ‘At the heart of this lies the need for Government to wake up to the long-term impact its underfunding of the sector is having. High quality costs, and is at risk unless more investment is made.’

In response to our findings, a Department for Education spokesperson said, ‘Early years providers are responsible for setting the pay and conditions for their employees.’

TESTING OUR DATA

While this survey provides a useful snapshot, it may not necessarily be representative of the entire childcare workforce. We wanted to test the reliability of our findings, so we commissioned the Education Policy Institute to do some further analysis of the Labour Force Survey, which uses representative data from the entire population, broken down by profession, and is collected by the Office for National Statistics. Last year the EPI found that 44 per cent of childcare workers are on benefits – higher than those working as teachers (30 per cent), those in occupations with similar pay such as hairdressing (40 per cent) and ten per cent higher than the general population of female workers (34 per cent).

Of those on benefits, 66 per cent are nursery nurses, 27 per cent are childminders and 7 per cent are playworkers. The most popular after the universal child benefit were tax credits (29 per cent of all childcare workers).

It also found that the mean gross hourly rate of pay was £8.20 – equivalent to £17,056 per year, similar to our findings.

EPI found that 47 per cent of childcare workers are single, and 45 per cent are married, and 58 per cent have children. The Labour Force data also indicated that at least half (54 per cent) of those receiving some sort of benefit (not including Tax-Free Childcare) were married, but this was based on small sample sizes. However, the fact that nearly half of childcare workers are married (and thus can be assumed to have a joint income), along with the relatively high overall numbers of workers on benefits, seems to bear out Nursery World’s findings that working in childcare leads to poverty-level household incomes in a significant proportion of cases.

EPI also found that while 43 per cent of childcare workers own a house with a mortgage, 38 per cent are in rented accommodation. This builds on the EPI’s previous findings that childcare workers and their families suffer from ‘high levels of financial insecurity’ – in the wider population, private renters accounted for 20 per cent of all households, and 62 per cent of householders are owner-occupiers. The number of childcare workers in social housing (18 per cent) is equivalent to the national average.

Sara Bonetti, associate director of early years at the EPI said, ‘With many childcare workers forced to spend much more than the recommended 30 per cent of income on housing costs, the Government should consider how it can offer workers greater financial stability. Failure to respond to these pressures could lead to more leaving the sector.’

‘How does your financial situation affect your ability to do your job?’

Here is a sample of responses to this survey question. Some said it doesn’t affect their ability to do their job, though some referenced their partner’s income as a key means of continuing in the job:

- As I’m a solo earner, what I earn is all the money for the month and after taking our rent and bills then a food shop we are lucky if we have £100 left. So no holidays or day trips and my mum buys most of my daughter’s summer clothes.

- I own a nursery and do not take a wage to ensure there is enough to cover bills and staff wages. I suffer with depression, high anxiety and am in counselling due to stress.

- I cannot afford to have time off, even if I’m ill, as if I don’t work I don’t earn anything. It’s demoralising to know that, as a graduate, I’m earning less than someone stacking shelves in a supermarket.

- I am in a constant state of worry, I have been on anti-depressants for years, but work keeps me going. If it wasn’t for my ill-health making it difficult for me to find other work I would have moved on. I worked hard for my degree and Early Years Teacher Status but this has never been used to its full potential and made very little difference to my hourly rate.

- If it wasn’t for my student loan which will stop next year, I would be using a food bank. As a graduate I earn £9.80 per hour and am in horrendous debt.

- It affects me more at home as I get upset about not giving my daughter a good life.

- I’m very lucky my job is for the icing on the cake. My husband works incredibly hard in the military and we have a good standard of living.

- Unfortunately there are times when my children go without in order for me to provide a service parents are willing to pay for. There is a huge problem within childminding where we are required to pay for things like public liability, first-aid, etc. even on maternity leave.

- We chose to only have one child as we knew having more would affect our financial security.

Case study: 41 and living at home

‘I’m Level 3 qualified and work as a nursery nurse in a school nursery. I come in at seven or half seven in the morning and don’t leave until five. I come in my holidays too sometimes to sort work out. I do parents’ evenings after school. I have my own family groups and write reports as well as the usual day-to-day teaching and prep.

‘I still live at home even though I’m 41, and can’t afford to move out on the wage I’m on. I couldn’t tell you the last time I went on holiday and am struggling to save a deposit or pay for day-to-day items, bills and living. But as someone working in early years, my pay isn’t considered important enough to change.

‘In my last professional development meeting my supervisor actually said to me “other than become a teacher, there’s nowhere else for you to go”. This is quite deflating as I am quite ambitious and have taken on quite a lot of extra responsibility outside of my job role which I asked to do. I don’t see why I should become a teacher when I enjoy the job I do. The problem is early years workers do a valuable job and do not get paid for it.’

Parents: ‘Government must act’

Father-of-six James Anderson-Hanney said, ‘I think it is absolutely scandalous that workers in childcare are so poorly paid – most children spend more waking hours with these people than their own parents, during years when they are forming a blueprint for the rest of their lives. How can our children receive the commitment they deserve if those providing their care are struggling with hardship?’

Mum-of-two Emma Blick said, ‘How can these working conditions create a positive, happy environment for our children to thrive and learn? Parents cannot afford to pay any more, but more has to be done by the Government. We should all be able to go to work reassured that our children are happy, well looked after, safe and learning.’

Another parent said, ‘This is deeply distressing. The staff at my twins’ nursery are wonderful and caring, they go out of their way to not only keep them safe but actively encourage the children to play and explore. It is terrible to think that the very people I trust my children with, who work full time, could be struggling to make ends meet. The Government must act to subsidise childcare provision more fully.’

About our survey

- The survey ran from 23 July to 12 August 2019 and received 1,029 responses, 70 per cent of which were from nurseries and pre-schools, 21 per cent from childminders, and 6 per cent nursery schools or school nursery classes. Nearly a quarter – 24 per cent – of respondents are graduates, and 43 per cent had worked in the sector for 15 years or more. Thanks to the Education Policy Institute and Resolution Foundation for input. What does Government data tell us about the childcare workforce?