Download the pdf of this article

In the past decade, we’ve seen the introduction of funded childcare for two-year-olds and the expansion of three- and four-year-old places under the 30 hours scheme. But this dramatic expansion, which has made the Government many settings’ largest client, has not been met with any moves to maintain quality.

In the past decade, we’ve seen the introduction of funded childcare for two-year-olds and the expansion of three- and four-year-old places under the 30 hours scheme. But this dramatic expansion, which has made the Government many settings’ largest client, has not been met with any moves to maintain quality.

In a workforce that has had a traditionally high proportion of Level 3-qualified staff, the effects are being felt. In fact, qualification levels have been on a downward trend over the past few years. According to our report, The early years workforce: a fragmented picture, published last March:

? The proportion of Level 3-qualified staff fell from 83 per cent in 2015 to 75 per cent in 2016.

? The percentage of two-year-olds with a graduate in the room decreased from 45 per cent in 2014 to 44 per cent in 2016, with significant geographical variations.

? Career progression has slowed, with high and increasing proportions of staff not working towards higher qualifications.

This data, combined with the fact that the most-qualified employees tend to be older, prompted us to ask: what will happen to the proportion of qualified staff in the future?

What kinds of setting?

According to the 2016 data England had:

? 25,500 group-based providers

? 17,925 school-based providers

? 46,600 registered childminders.

These settings offered just over three million Ofsted-registered childcare places between them. Until that year, the number of providers and registered places increased continuously, with birth and migration rates and the introduction of the new entitlements all contributing to this rise. But while there are more children, and more demand for places, the composition of the childcare market is changing: the number of private, voluntary and independent (PVI) providers has decreased and the number of maintained schools is on the up.

DfE figures show that in 2017, 22,730 providers offered provision to two-year olds: 70 per cent were PVIs, seven per cent were maintained schools and 19 per cent were childminders. PVIs have always provided the lion’s share of places for two-year-olds, but in the past three years they have started losing some ground to the maintained sector.

Trend 1: More school provision for two-year-olds

Schools are likely to play an increasing role in delivering nursery places. To understand why, we need to consider two elements: first, the demand for places for two-year-olds is unlikely to increase substantially because of the slower population growth since 2013, the levelling off of entitlement uptake (at 72 per cent in 2018), and the negligible impact of entitlement changes brought by Universal Credit (estimated at around 7,000 additional children).

Secondly, the growth of the maintained sector is constrained by availability of buildings. Anecdotal evidence also suggests that the 30 hours entitlement is pushing PVIs to shy away from two-year-old provision because of its high costs. This led us to assume that the providers’ growth rate will follow the trend set since 2016 (PVIs slowly decreasing, maintained schools slowly increasing) and to forecast that in 2023 there will be around 15,200 PVIs and 2,300 maintained providers of places for two-year-olds, with their proportional role changing to 64 and 10 per cent.

Trend 2: Potential hours shortage for three to fours

Similar considerations apply to the case of three- and four-year-old provision. In 2017 there were 47,670 providers serving three- and four-year-olds (including 19,710 PVIs and 16,220 maintained schools) with both types of providers growing slowly.

The Government commitment of £100m in capital funding to support the delivery of the 30 hours entitlement should help boost supply. Slowing population growth, and the fact that three- and four-year-old provision is already almost universal, mean we expect demand to increase significantly in terms of hours rather than numbers of children.

Around half of parents of three-year-olds took up the additional hours by summer 2018, but a survey by the Department for Education suggests that another quarter intended to, and thus that there is unmet demand for the extra 15 hours of entitlement.

If the 400 capital projects funded by the DfE each created 39 places (the average size of a PVI), they would deliver only 15,600 additional places. Yet the potential shortage based on parents who intended to take up the extra hours, but have not yet done so, could amount to 300,000 15-hour slots.

PVIs are key to the 30 hours – 82 per cent of children benefiting from it do so at a PVI. Yet the number of PVIs fell 1.9 per cent between March 2012 and March 2018, according to Ofsted. Meanwhile, the number of PVI places increased 3.7 per cent, hinting at a concentration of more places in fewer providers.

Trend 3: More unpaid staff

Expansion of provision requires staff as well as new buildings. In 2016 there were an estimated 452,100 paid staff in the early years sector, with 270,600 working in group-based provision and 135,000 working in school-based provision, with both paid and unpaid staff increasing in number since 2008.

Assuming the same trend, in five years we can expect the total number of paid staff to increase to around 485,000 (321,000 in group-based and 164,000 in school-based provision) and the number of unpaid staff to reach 66,000. That will bring the number of unpaid staff to over 13 per cent of the total workforce from 11 per cent in 2016.

Trends 4, 5 and 6: Lower qualifications, an older workforce and staff shortages

Despite the recent rise in staff numbers, capacity in PVIs is precarious because of the shortages of Level 3-qualified or graduate staff, resulting in the current recruitment crisis. Consolidation of places into larger providers and staff who are not qualified to enable high staff:child ratios are forcing providers to employ a higher number of staff with lower qualifications.

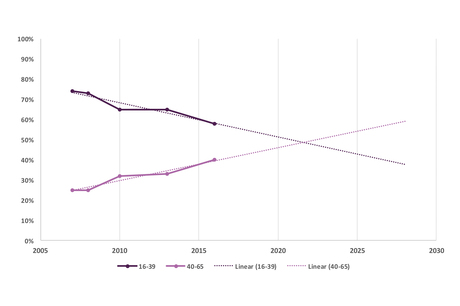

These concerns are likely to be multiplied in the next five years as the workforce ages. Given that an increasing proportion of workers are aged 40 or older, we created projections to identify when the number of younger cohorts (16- to 39-year-olds) would not be enough to replace those leaving. We used optimistic assumptions, such as that all staff would retire at age 65 and all younger workers would stay in the sector – which of course they won’t.

We found that if the number of staff joining the early years sector does not rise significantly, there will be increasingly severe staff shortages. As things stand, 2022 will be the first year when the majority of staff are over 40 years old (see graph).

This comparison of entrants versus leavers translates as the number of full-time paid staff in group-based providers falling from 270,600 in 2016 to 257,000 in five years – and plummeting to just over 200,000 in ten years.

Also, 21 per cent of staff qualified at Level 6 or higher are aged 50 years-plus and will be approaching retirement within the next ten to 15 years. If trends continue, by 2023, 80 per cent of group-based staff will not be working towards a higher qualification level. Matching this with data on the decreasing number of Level 3 staff since the (temporary) introduction of GCSE English and maths requirements, it is not surprising that providers are experiencing difficulties hiring Level 3 staff.

Running out of time...

While projections are not set in stone, those above present a troubling picture for the sustainability and quality of provision if things stay as they are.

Without drastic action to improve the incentives to work in childcare, the sustainability of the free entitlements appears to be at risk, with PVIs facing the brunt of staff shortages. PVI staff are paid less than school-based staff at any level of qualification and in any role, with senior staff in group-based settings paid less than junior nursery and Reception staff.

Survey data shows that part-time labour is more prevalent in PVIs than in the wider labour market (51 per cent versus 26 per cent). Meanwhile, there appears to be an increase in the use of contracts paying below the rate at which National Insurance contributions are made, and of agency staff in order to cut costs.

The typical traits of ‘low qualifications, low pay and low status’ do not seem to be improving following recent workforce policies, and new capital funding to create additional places does not match the potential size of the demand for the 30 hours entitlement.

Entry-level pay rates above the National Living Wage, sensible pay differentials for staff at different qualification levels and a strategy for career progression are needed to increase job stability and status, and to make the early years sector more attractive to new and qualified practitioners. In absence of any policy changes in this direction, recruitment is likely to become even more challenging.

It will also be important to monitor the recent concentration of PVI places into larger nurseries. While this provides scope for economies of scale and more opportunities for professional development, it might also bring the need for additional regulation of working conditions, fair access to provision for children with special educational needs and disabilities, and geographic availability.

These trends are not irreversible, but they require an urgent and long-term commitment to the sector. With the demographic trend we have identified, and an unmet demand for the 30 hours entitlement, the Government is running out of time to intervene before a visible shortage of places materialises.