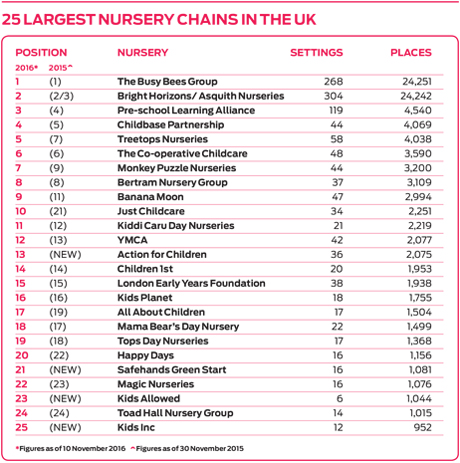

If there’s a story to this year’s league table of the top 25 biggest nursery chains in the UK, it’s one of consolidation and growth, particularly for the biggest names. Just days after we went to press, Bright Horizons acquired Asquith Nurseries, in the biggest deal for many years, putting them just nine places behind Busy Bees and second place in the table.

With these two behemoths way out in front, the gap between them and the rest of the large nursery groups is now even wider.

This means that the Pre-school Learning Alliance is now in third position – even though it has almost 20,000 fewer places than the second biggest group.

The Asquith deal follows a year of acquisitions for Bright Horizons, after buying Little Unicorns and the Phoenix nursery in Brentford in the summer. The group also opened three new settings in the autumn.

Prior to this, the biggest buyout of the year was the sale of the Positive Steps group to Busy Bees, reportedly worth more than £25m.

This acquisition in the summer added an extra 600 childcare places to the group, with eight more settings in Surrey, Hertfordshire, Buckinghamshire, Berkshire and Kent.

It was the third deal for Busy Bees in less than a year, following the buyout of Bush Babies in May and Kids 1st’s 11 nurseries last December.

The chain also has a number of potential acquisitions planned for the next couple of months and into 2017.

Meanwhile, also in the top half of the table, Derby-based group Treetops has bought the family-run Yorkshire chain Kindercare, adding ten more sites.

In May, Treetops secured £27m in investment from Barclays Bank to fund expansion over the next four years. Previous investment from the bank has enabled the group to grow from 31 sites to 58 in just four years.

Treetops is now in fifth position in the table with 4,038 places, close behind the Childbase Partnership, which has 4,069.

Franchise groups Banana Moon and Monkey Puzzle were new entries to the table last year and both have grown their businesses in the past 12 months. Monkey Puzzle now has 44 sites and more than 3,000 places, and is at number seven. Moreover, the group has plans to open 17 more nurseries in the next sixth months.

Banana Moon is not far behind, in ninth place with 47 settings and just shy of 3,000 places. It says it has plans to open 15 more nurseries in the next year.

The evidence from these two groups clearly shows that the franchise model for operating nurseries enables rapid expansion.

Also on the up, Just Childcare – new to last year’s table – has jumped 11 places to number 10, adding an incredible 14 sites in the past year.

Meanwhile, Action for Children is a new entry in 13th place after taking on the majority of the nurseries previously operated by 4Children, after the organisation folded earlier in the year.

Many of the nursery groups in the bottom half of the table are also continuing to add to their number and have expansion plans for next year.

All About Children, the group founded by ex-Asquith chief executive Russell Ford, is continuing steady growth and after just six years of existence now operates 17 nurseries and is at number 17 in the table.

Kids Planet has opened three new sites and has secured £10m in investment from the Business Growth Fund to open or acquire new sites in the North West over the next two years.

In addition to Action for Children, Safehands Green Start in 21st place Kids Allowed in 23rd, and Kids Inc in 25th are the other new entries.

Kids Allowed may have just six settings but offers just over 1,000 places. It also has plans for further growth, opening a 180-place nursery in Altrincham in the next year, as well as a 150-place setting, also in Greater Manchester.

So, what can the top 25 table tell us about the state of the sector?

Despite ongoing concerns about the funding for the 30 hours entitlement and the long wait for a workforce strategy, the figures suggest that the largest nursery groups in the UK are continuing to attract investment and to grow.

The top 25 now offer a combined total of 98,004 places across 1,302 settings. This is an additional 8,447 places and 94 settings on last year’s Nursery Chains figures.

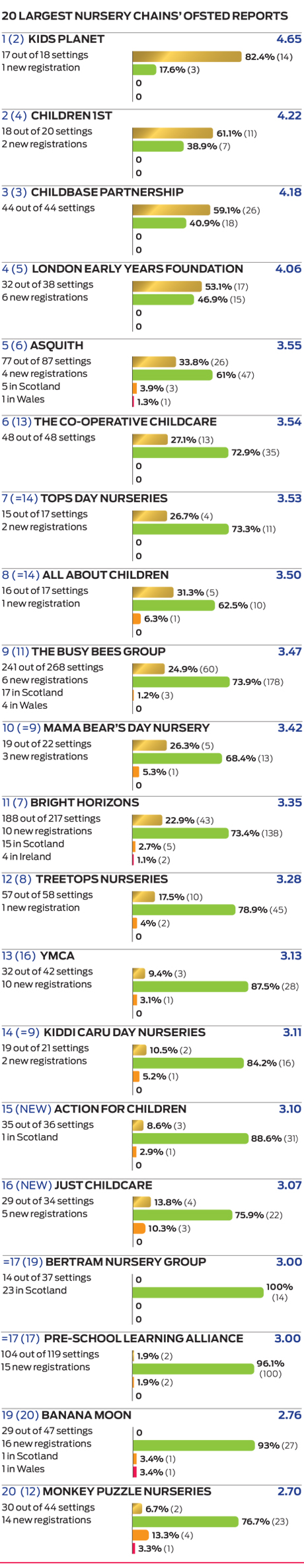

Ofsted reports

This year’s Ofsted table, ranking the largest 20 nursery groups in terms of quality, has a new group in first position for the first time in six years.

Congratulations to Kids Planet, in second place last year, and now at the top of the table with 14 of its nurseries graded Outstanding and three with Good grades.

Kids 1st, previously holder of the top spot for five consecutive years, is now owned by The Busy Bees Group, so its grades are no longer counted separately.

Children 1st is in second place with 11 Outstanding nurseries, and seven graded Good.

The top four groups have all of their English nurseries graded either Good or Outstanding.

And there has also been a rise since last year in the proportion of nurseries graded Good or Outstanding across the table.

The nurseries owned or managed by the largest groups can congratulate themselves on achieving 96.4 per cent of their settings graded either Good or Outstanding.

More than a quarter of the nurseries in our Ofsted table are graded Outstanding (25.4 per cent), and just under three-quarters (71 per cent) are graded Good.

This leaves a very small proportion of settings graded as ‘requires improvement’ or ‘inadequate’.

The top 20’s performance outstrips Ofsted’s most recent national statistics (31 March), which showed that 86 per cent of early years settings were graded Good or Outstanding in their last inspection.